In days gone by, shareholders of large banks viewed their investments as a source of income via dividends and potential capital gains via share appreciation. In days gone by, depositors viewed banks as the safest place to harbor their hard earned dollars while earning a respectable amount of interest income.

In days gone by, shareholders of large banks viewed their investments as a source of income via dividends and potential capital gains via share appreciation. In days gone by, depositors viewed banks as the safest place to harbor their hard earned dollars while earning a respectable amount of interest income.

That was then, this is now. Both bank shareholders and depositors have awoken to the cruel reality of crashing bank stock prices, eliminated dividends and being robbed by the banks with near zero interest rates as the cost of living climbs relentlessly.

Many really unlucky people have seen the value of their investments in bank stocks completely wiped out as in the case of Washington Mutual’s collapse in which shareholders collectively lost over $41 billion. Additional countless billions of dollars of America’s middle class wealth has been vaporized by the failure of 453 banks since 2008.

How many retirement plans of hard working Americans have been disrupted by bank failures and zero interest rates is a question given little consideration even as the Federal Reserve and the Government have bailed out the banking industry with trillions of tax payers dollars. Meanwhile, savers have been robbed of interest on their savings via the financial repression of the Federal Reserve.

The highest rates available on on one year certificates of deposit are currently about 1%, and that’s before taxes and inflation. At a 1% interest rate, ignoring taxes, it would take a depositor 72 years to see his money doubled. For those with hope that interest rates on savings will eventually rise, think again. The Federal Reserve has all but promised that rates will remain near zero indefinitely as they continue their quest to aid the helplessly over indebted by maintaining rock bottom interest rates.

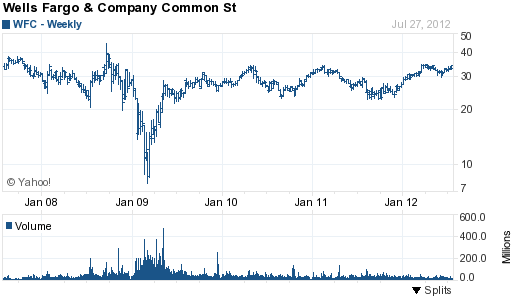

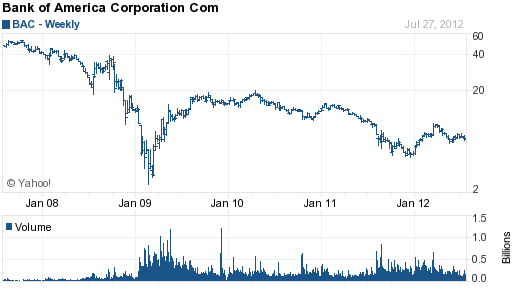

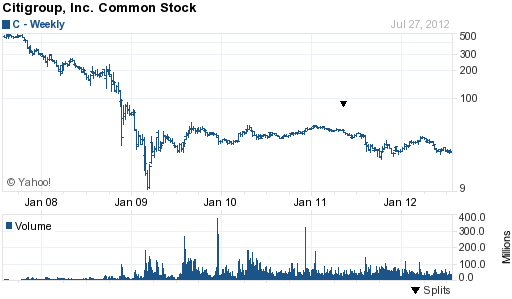

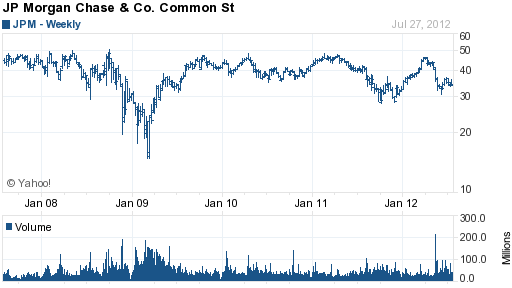

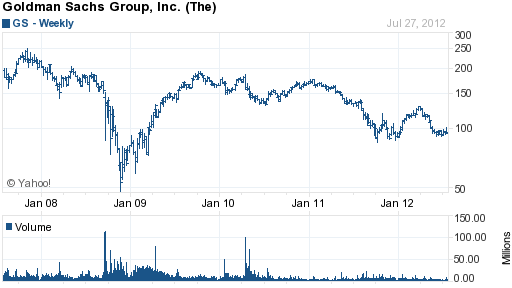

Here’s a look at the stock performance of the 5 largest too big to fail banks in the U.S. over the past five years. Note that even Wells Fargo, in which the famous Warren Buffett owns a large stake, has gone nowhere over the past five years. Shareholders in Bank of America and Citigroup are still sitting on massive losses which, in all probability, will never be recouped.

courtesy yahoo finance

courtesy yahoo finance

courtesy yahoo finance

courtesy yahoo finance

Inquiring minds may well wonder if top bank management has shared in the pain of shareholders and depositors. The one word answer is no – top banking executives at the largest banks still enjoy million dollar paychecks and bonuses despite their woeful performance.

The most bizarre aspect of the financial disaster that has impoverished bank shareholders and depositors is the lack of public outrage by the victims. Equally bizarre is the sight of regulators and politicians tripping over each over in an effort to reward borrowers who recklessly piled up debt without regard to the ability to repay (see Foreclosure Settlement – A Victory For The Irresponsible and Mortgage Default Is A Financial Bonanza For Many Homeowners).